If there is one thing that we at GoLocal have tried to make abundantly clear, it is that what you do with your money matters for you and your community. Going local with your spending by supporting locally owned, independent businesses causes a "multiplier effect" that keeps more money recirculating in our community. As illustrated here, a small shift in spending by everyone creates a huge amount of benefit that we all can take to the local bank . . . and should take the local bank, as our local banks and credit unions play an important role in our local economy that increases the impact of the shift.

Better for Business

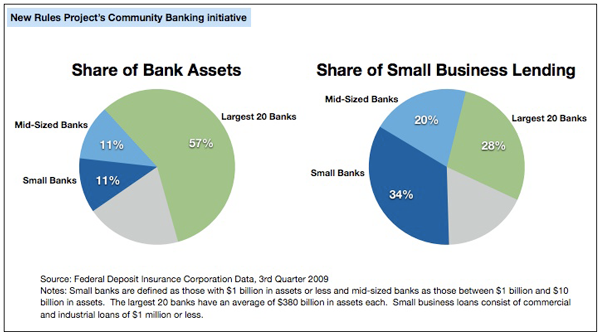

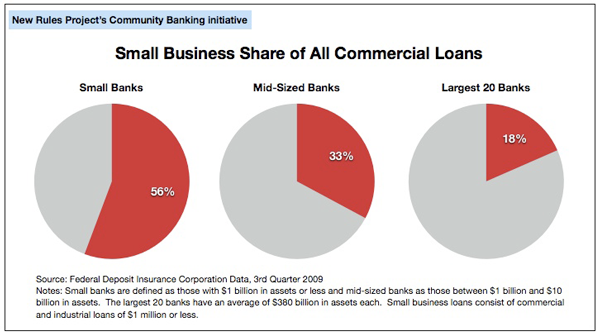

Small banks and credit unions are by far the largest supporters of small local businesses. A 2009 study by the New Rules Project found that small banks lend disproportionately more to support small businesses than their medium and large sized peers.

Small commercial loans also make up a larger percentage of the overall loan portfolios of small financial institutions, making it much more likely that a money deposited into a community bank or credit union will support investments in small local businesses.

As deeply rooted members of the community, local banks and credit unions operate at a scale where they can get to know their small businesses and the local market conditions. This allows them to be more flexible in making loans that don’t fit into the formulaic processes of the largest lenders.

Better for the Economy

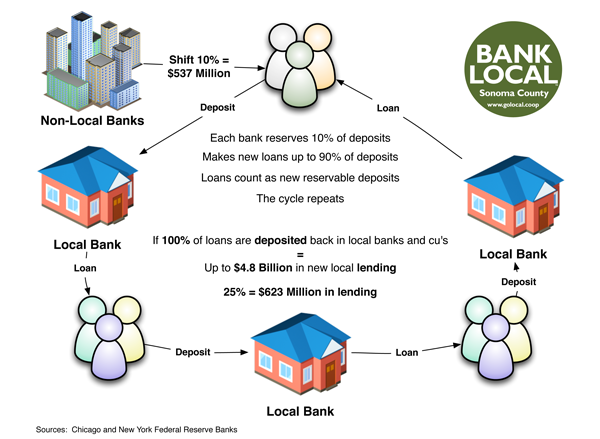

Shifting deposits to local financial institutions creates the potential for increased local lending of all types. Through the process of fractional reserve lending, the amount of new lending potential of local financial institutions created by a shift can be many times the amount of the initial shift.

Here’s how it works . . . The key concept is that financial institutions don't keep all of our money locked away in their vaults, but rather, lend against the money we deposit. This is known as fractional reserve lending, a process that allows banks and credit unions to lend to the point where deposits in reserve equal 10% of their total deposit base.

There is an important part of this process that is often overlooked . . . loans count as new reservable deposits. This means that the deposits created when banks lend can become new reservable deposits once the dollars make it back into another bank, and then 90% of those deposits can be lent, and then 90% of those deposits, and so on. In theory, banks can create new loans, essentially new money, totaling nine times the amount of the original deposit if 100% of the loan proceeds make it back into a bank each time.

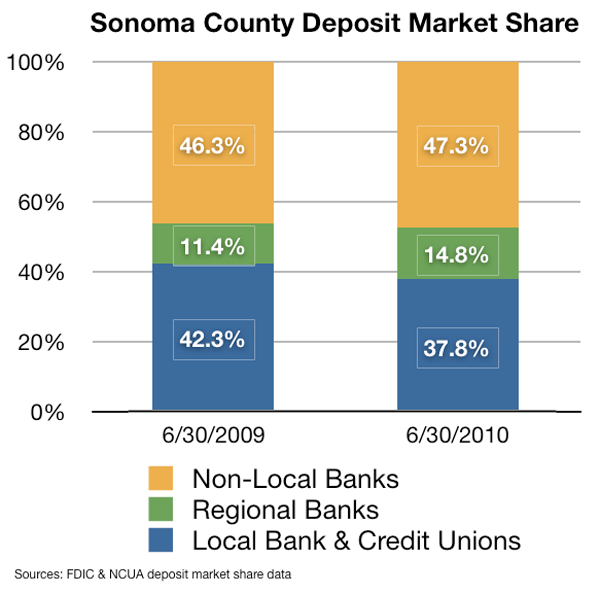

Currently, of the $11.35 billion dollars of traceable deposits in Sonoma County, 47.3% or $5.37 billion are held at non-local banks, defined as having less than 1.5% of their total deposits originating from Sonoma County. Shifting just 10% or $537 million of non-local deposits to local institutions could increase their lending potential by up to $4.8 billion if all the newly created deposits from loans make it back into a local bank or credit union. Even if only 25% of loan proceeds make it back into local institutions, this still increases the lending potential of local institutions by $623 million.

To unlock this new lending potential, local financial institutions need a large pool of qualified borrowers to lend to. An informal survey of the majority of Sonoma County’s local banks and credit unions by the GoLocal Cooperative revealed that they are struggling to find enough qualified borrowers to support their current deposit base.

But a glut of money at local financial institutions waiting to be invested is a good problem to have. By going local first with our spending, both personally and with our business transactions, as a community we can support the success of small local businesses that are the prime candidates for local lending. With successful businesses come successful business owners and increased employment opportunities, creating more qualified candidates for home and automobile loans. This virtuous cycle is the key to creating enduring well-being for all members of the community.

Better for You

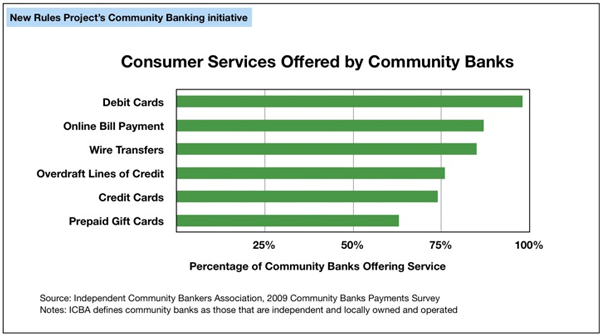

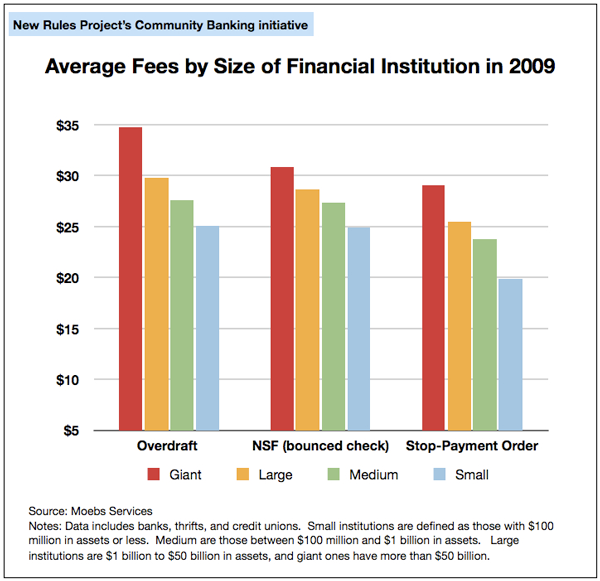

Besides the individual benefits each of us receive from a strong local economy, banking with local financial institutions also has a number of direct personal benefits. Recent data show that overall customer fees are significantly lower at small banks and credit unions, and in most cases those small institutions offer the same core services as the big banks.

Credit unions have the added convenience of a shared network of branches and ATMs throughout the country, making it easy to meet your banking needs wherever you are without expensive ATM charges.

As with most local businesses, community banks and credit unions pride themselves on getting to know their customers personally. They provide unmatched customer service, and, like they do with local businesses, can find ways to make personal loans that don’t fit into the formulaic models of the mega banks.

Make the Shift

Want a stronger local economy in Sonoma County? . . . Take action by banking locally. Switching is easy with our Bank Local Switch Guide. Check out our bank and credit union profiles, and visit our business directory to find a local bank or credit union with a branch near you. And join GoLocal to keep making shift happen.

Deposit and lending data was gathered from the FDIC, NCUA, and Federal Reserve. Information and graphics on small business lending and customer fees was kindly provided by the New Rules Project’s Community Banking Initiative (www.newrules.org/banking).