What you do with your money matters for you and your community. When you use local banks then you access accessible lending opportunities, lower fees, and reinvest in your local economy.

Better for your Business

Local banks are likely lenders to small businesses.

It is much easier, simpler, and more accessible to get a loan from a local bank for your small business rather than a national or international bank. A study performed in 2023 by the Federal Reserve Bank of St. Louis titled “Small Banks, Big Impact: Community Banks and Their Role in Small Business Lending” states that community banks play a significant role in funding small businesses (Beiseitov). Indeed, Ben Gran–a banking reviewer and writer for Forbes Magazine–writes that, “...community banks…tend to support their local communities, obtaining many of their core deposits locally and making loans to local businesses” (Gran). Small banks and credit unions are by far the largest supporters of small local businesses.

Additionally, in a 2019 article, Points West Bank stated that, “According to BankBound, Community banks, on average, devote more than 50% of their lending to small local businesses (compared to just 18% at the 20 largest banks)” (Points West Bank).

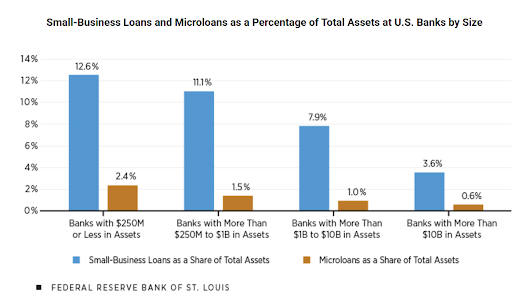

Even more, the figure below displays how small business loans “...accounted for 12.6%, 11.1% and 7.9% of total assets at three different sizes of community banks…” (Beiseitov). In contrast to this, larger banks reported that small business loans only accounted for 3.6% of their total assets (Beiseitov).

“...the following figure illustrates, small-business loans—i.e., loans less than $1 million—accounted for 12.6%, 11.1% and 7.9% of total assets at three different sizes of community banks (those with $250 million or less in assets, those with more than $250 million to $1 billion in assets, and those with more than $1 billion to $10 billion in assets, respectively.) Larger banks, those with assets of more than $10 billion, held just 3.6% of their total assets in small-business loans” (Beiseitov).

Local banks approved 82% of loan applications from small-business applicants, whereas only 68% of those applying at larger banks received similar approval according to a 2022 article by Patricia Moore, a director at the financial institution Connexion Solutions Corporate Capital (Moore). Patricia expands on this by writing, “These banks offer tailored business loans, lines of credit, and SBA loans with flexible terms and competitive rates, catering to the specific needs of local businesses…” (Moore).

Better for You

Want to work with people who understand you and provide lower fees? Bank locally!

Low fees and personalized service are the reasons many people consider when deciding on a banking institution. These are key factors that large banks are missing and local banks provide. Yes, banking locally can save you money and provide the opportunity to work with a company that knows your needs and community.

You can get a credit card at a more reasonable rate with local banks. The Consumer Financial Protection Bureau’s survey of 150 credit card issuers in 2023 which found that, “...large institutions were more likely to charge annual fees than small institutions and credit unions, with 27% of large issuers’ card products charging an annual fee compared to just 9.5% of small firms. Large institutions’ annual fees were also higher than at smaller banks and credit unions, averaging $157 as opposed to $94 for smaller issuers” (CFPB Office of Markets). Also, smaller banks usually offered cheaper interest rates “...than the largest 25 credit card companies across all credit score tiers” (CFPB Office of Markets).

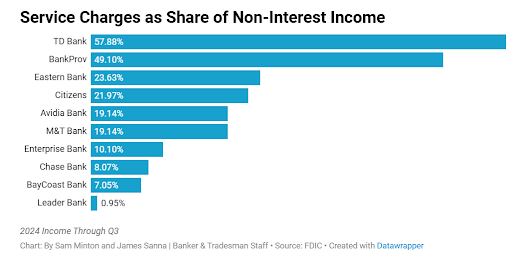

Local banking can save you in fees, too. Sam Minton, a writer for Banker and Tradesman, a digital real estate and financial information news outlet, conducted a 2024 survey that investigated how much large institutions are making from non-interest income–income usually earned from fees. Minton writes that TD Bank, a large institution, earned a startling $654.65 million from bank fees in 2024 which equates to 57.9% of their non-interest income reported to the FDIC (Minton). On the other hand, as seen in the figure below, local banks like BayCoast and Leader’s service charges only contributed 7.05% and 0.95% to their non-interest income (Minton). Once again, this shows how local banking is the way to go if you want the best savings.

Banking locally also means working closely with a financial institution that knows your community and therefore your needs personally. Local banks are typically more involved in their local communities which allows them to understand and meet the needs of small businesses. In contrast to large nationwide chains, community banks often practice relationship-based banking and Forbes Magazine explains how bankers may have more flexible credit assessment processes compared to larger banks, allowing individuals and small businesses to obtain credit that might not qualify under a big bank’s criteria (Gran).

Better for the Sonoma County Economy

A great reason to bank locally is that it contributes to the Local Multiplier Effect.

Local banks also fund real estate and builders which create employment opportunities and therefore economic development. Indeed, F&M Bank explains how local institutions fund developers that’re seeking to renovate or build homes, complexes, or even commercial buildings (F&M Bank). In short, when these small local businesses borrow from local banks, then they’re able to create employment opportunities, which is not only good for the economy, but also funds the community as well.

Best for the Community

Best for the Community

Local communities thrive when you bank locally.

Local banking institutions support charities, nonprofits, and community programs, which fosters economic growth. For example, Exchange Bank has supported 255 nonprofits like Santa Rosa Community Health, Canine Companions, and Catholic Charities of Santa Rosa. Their employees also volunteer hundreds of hours every year at Redwood Empire Food Bank (Exchange Bank). This local bank serves as one of many examples of how opting for a local bank is favorable compared to national banks which don’t involve themselves in their host communities as much as a local institution.

Another benefit of banking locally is that it fuels your community. In fact, even Falcon National Bank states that smaller banks help stimulate and maintain the local economy but also details how, “In underserved communities, the local financial institution may be the only economic resource to sponsor local events. When a community bank or credit union contributes to a school fund-raising activity, this lifts families up throughout the area” (Falcon National Bank). Yes, banking locally means supporting an institution that likely invests in local organizations or initiatives which can fund programs that help the community, like affordable housing projects or community centers (F&M Bank).

Education Opportunities

Local banks care about your education.

When you bank locally, then you support a bank that supports you! Community banks offer scholarship opportunities for college and donate to local high schools. Exchange Bank offers the Frank P. Doyle and Polly O’Meara Doyle Scholarship Fund and the Elsie Allen High School Foundation which uplifts underserved students.

Local banks and credit unions also offer financial education classes. Take a look at Redwood Credit Union’s Financial Education Center which offers education in saving, spending, borrowing, and financial planning (RCU).

F&M Banks says that, “…financial education programs help individuals and business owners make informed decisions about their finances, which can lead to improved financial health and security for themselves and their families” (F&M Bank).

What about Credit Unions?

Firstly, according to a 2024 article by U.S. News, credit unions differ from banks because they are non-profit institutions which require membership, but often offer lower interest rates, fees, and higher saving rates than banks (Oliveira).

So, if you prefer a credit union over a bank, then going locally is still the best option because it will provide you with even more savings and great customer service. These competitive rates, personalized service, reduced fees, and even financial education classes from local credit unions are similar to a local bank. In fact, The Money Mill, a blog edited by Jeanne D’Arc Credit Union, writes that local credit unions can offer even lower rates than a local bank, “…due to their not-for-profit structure, which allows them to reinvest earnings into better products and services for their members” (The Money Mill).

Take Redwood Credit Union as an example of what local credit unions have to offer. Redwood Credit Union supports community programs like the Boys and Girls Clubs of Sonoma-Marin by donating $250,000 from the Redwood Credit Union Community Fund and endorsing Celebrate Community which supports volunteerism (RCU). Also, in 2023 RCU employees “…assembled 418 bicycles for children at 11 nonprofits in 22 communities,” which they dub as their “Day of Impact” (RCU). In addition, Community First Credit Union provides free educational articles focussed on personal loan scams, cybersecurity, and home loans. CFCU even offers up to seven $1,000 and two $2,500 scholarships every year (CFCU)! These two examples show how vital local credit unions are and the positive impact they make on education as well as the community.

Works Cited

Beiseitov, Eldar. “Small Banks, Big Impact: Community Banks and Their Role in Small Business Lending.” Federal Reserve Bank of St. Louis, Federal Reserve Bank of St. Louis, 9 Nov. 2023, www.stlouisfed.org/publications/regional-economist/2023/oct/small-banks-big-impact-community-banks-small-business-lending.

CFPB Office of Markets. “Credit Card Data: Small Issuers Offer Lower Rates.” Consumer Financial Protection Bureau, 16 Feb. 2024, www.consumerfinance.gov/data-research/research-reports/credit-card-data-small-issuers-offer-lower-rates/.

CFCU. “Financial Literacy: Online Classes: Community First CU.” Financial Literacy | Online Classes | Community First CU, 2025, www.comfirstcu.org/members/education.

Exchange Bank. “Community: 100% Giving Stays Local.” Exchange Bank, 2025, www.exchangebank.com/about/community.

Falcon National Bank. “Community Banks: How Banking Locally Supports Your Town.” Falcon National Bank, 6 Feb. 2024, www.falconnational.com/blog/post/community-banks-how-banking-locally-supports-your-town.

F&M Bank. “Farmers & Merchants Bank.” F&M Bank, 2025, www.fmbnc.com/local-banks-the-future-of-community-investing#:~:text=Some%20local%20banks%20use%20community,programs%20that%20benefit%20the%20community.

Gran, Ben. “What Is a Community Bank?” Edited by Doug Whiteman, Forbes, Forbes Magazine, 11 Aug. 2021, www.forbes.com/advisor/banking/what-is-a-community-bank/.

ICBA. “About Community Banking.” ICBA, 2024, www.icba.org/about/community-banking.

Minton, Sam. “Smaller Institutions Battle Big Banks with Reduced Fees.” Banker & Tradesman, 29 Dec. 2024, bankerandtradesman.com/smaller-institutions-battle-big-banks-with-reduced-fees/.

Moore, Patricia. “The Role of Community Banks in Supporting Local Businesses through Tailored Loan Products amidst Economic Recovery Efforts in 2024.” Connexion Solutions Corporate Capital, 23 Nov. 2024, www.connexionsolutions.com/insights/the-role-of-community-banks-in-supporting-local-businesses-through-tailored-loan-products-amidst-economic-recovery-efforts-in-2024/#:~:text=You%20Need%20To%20Know%201%20Community%20banks%20hold,specific%20needs%20of%20local%20businesses%20%5BBACKGROUND%5D.%20More%20items.

Oliveira, Sebastian. “Credit Union vs. a Bank | Banking Advice | U.S. News.” U.S. News, 5 Dec. 2024, www.usnews.com/banking/articles/credit-union-vs-a-bank.

Points West Community Bank. “The Benefits of Banking Local.” Points West Community Bank, 21 Aug. 2019, pwcbank.com/blog/2019/08/21/the-benefits-of-banking-local/.

RCU. “An Investment in the Youth of Roseland.” Redwood Credit Union Community Fund, Redwood Credit Union Community Fund, 22 Nov. 2024, www.rcucommunityfund.org/impact-blog/blog-post-title-one-66xcn.

RCU. “Community - about Us.” Redwood Credit Union, 24 Oct. 2024, www.redwoodcu.org/about/community-programs/?ref=whats-new.

RCU. “Financial Education.” Redwood Credit Union, 28 Feb. 2025, www.redwoodcu.org/resources/education/get-started-financial-education/.

The Money Mill. “Why Credit Unions Are Good for Local Communities.” Jeanne D’Arc Credit Union, 18 Sept. 2024, www.jdcu.org/blog/why-credit-unions-are-good-for-local-communities/.